According to price data provided by Irontrade.com, EUR/USD at this moment remains in a clear downward trend. The question is if there are any prospects to reverse this decline and start growing? Well…with the current prices for energy resources, that is a good question. Natural gas in storage is almost finished, but the winter is not. Moreover, we expect pretty cold March so far.

Fundamental arguments

Fundamentally, EUR is more uncertain than USD. The conflict near Germany and gas resources will obviously not suit the whole continent. Energy prices will rise even higher, and there will be nowhere to take more resources.

Technical arguments

Technically, the pair is at its peak and continues to storm minimum levels. Still, it rose slightly and went into a correction from the support line.

Analysis of big traders

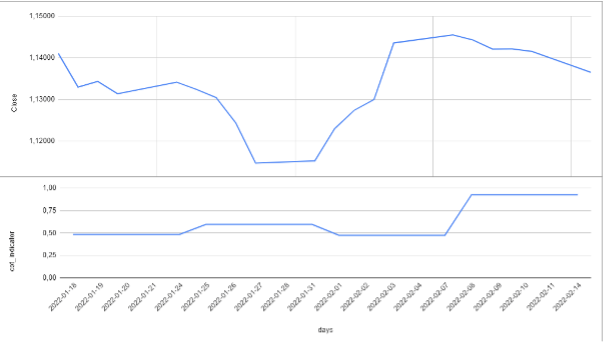

Picture 1. The price chart of the EUR/USD and the indicator of big traders for the period 18.01.2022 – 14.02.2022. The data is presented by Irontrade.com.

As we can see in picture 1, an indicator shows a sharp increase in demand for EUR. It is unclear whether this demand is an attempt to hedge liabilities in EUR or fueled by the warm season approach. Usually, during the warm seasons, there is reduced dependence on energy resources and the opportunity to get gas with a discount.

Forecast

Taking all of the above into account, we believe that in the next couple of weeks, there will be a correction for the EURUSD, and the price will go “up”. This is indicated by factors such as increased demand for EUR, recent support on the chart, and approaching a warm season.

We recommend using Stochastic (14, 1, 3) for better control over positions. Stochastic allows you to determine the current cycle of the established sideways trend.

We suggest keeping an average ratio of 4 trades UP and 3 trades DOWN to keep the level of risk moderate.

Try to implement this strategy on IronTrade! It is pretty convenient to do proper risk management there while receiving significant profit. Good luck!