There is intense competition for natural gas in Asian markets, which has lasted for a while already. Like a black hole, China pulls energy supplies and agrees to pay more for gas, which puts Europe at a disadvantage and hits the JPY. Here is a brief analysis from IronTrade about current situation.

Fundamental arguments:

Despite all the positions and promises, the EUR will fall into a deep crisis before the start of the heating season because of the gas prices. The same situation with the JPY – they also feel pressure because of higher electricity costs, primarily affecting production consumers.

Technical arguments:

The pair continues its downward trend, being on the sidewalk near the resistance line and seeking support. Similarly, recent growth has not taken root at the resistance level.

Analysis of big traders:

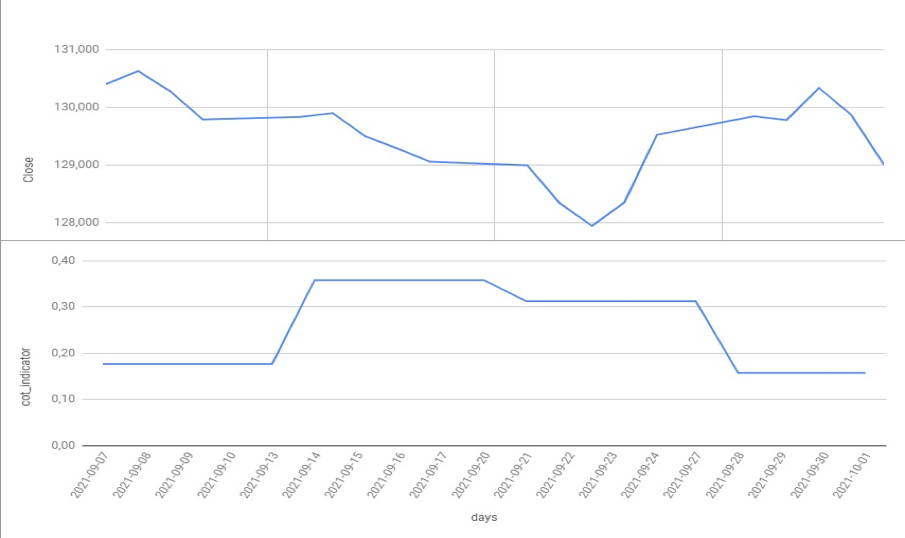

Picture 1. The EURJPY chart and the indicator of big traders for the period of 07.09.2021-01.10.2021.

As we can see in picture 1, the demand for the EUR caused a sharp fall against the JPY. It was corrected only after a reduction in the net EUR position. This situation reflects the bearish market opinion about the EUR.

Forecast

In view of all the above, IronTrade expects a DOWNWARD movement of the EURJPY. It is indicated by the next update of the local demand minimum for the EUR and the increase of gas prices.

IronTrade recommends using the Stochastic (14, 1, 3) indicator to control your positions better.

Stochastic helps to recognize market cycle changes in side oscillations and shapes.

Finally, we recommend keeping 2 trades that aim downwards movement and 1 trade for upward movement.