According to the latest data from the Irontrade analysts, EUR/JPY remains in a correction now. However, is there any prospect on the markets with the current cost of energy resources? It seems like weather forecasters were quite right in their predictions this year, and Europe may well face not a one-time cold snap but a real winter.

Fundamental arguments

Fundamentally, the JPY is more confident than the EUR because the JPY is trying not to clash with its gas suppliers while Europe has yet to find a way out.

Technical arguments

From the technical point of view, the pair remains in a sideways position not far from the lows. However, this situation looks more like the end of the sidewall in anticipation of the fall…

Big traders analysis

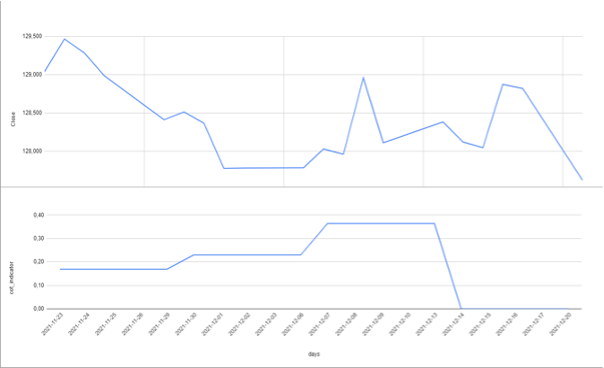

Picture 1. The EUR/JPY price chart and the big traders’ indicator for the period 11.23.2021 – 12.20.2021. The data is presented by Irontrade.com.

Picture 1 shows the indication of a sharp drop in the position and a further downward movement, with a renewal of the minimum.

Forecast

We expect the asset to move DOWN. This is indicated by a decrease in the amplitude of the bounce from the support line and a sharp reduction in the positions of traders. Also, fundamentally the JPY seems more robust than the EUR, including the situation in the energy crisis.

We recommend using SMA (50) for better control over your positions.

SMA helps to watch the trend and ignore minor fluctuations.

We suggest keeping an average ratio of 5 trades DOWN and 2 trades UP to keep the level of risk moderate.

Try to implement this strategy at IronTrade.com! It’s pretty easy to do it there. Also, it’s painless to limit your risks while getting high returns. Good luck.