The expectations regarding fuel prices and monetary policy are far from reality, which has become this year’s trend. No matter how it is beaten, the Dollar continues to bear the burden, while the Euro is going in for dramatics in the run-up to winter. Here is a brief analysis of the current market situation from IronTrade.

Fundamental arguments

From a fundamental point of view, newly printed US Dollars will not change the trend. It is not a secret that the USA expenditures have long exceeded revenues. Every cent of debt will have to be repaid by even more expensive credit. On the other hand, the USA is accustomed to this as they live long in such a situation. At the same time, Europe anticipates a cold winter with such energy prices for the first time.

Technical arguments

From a technical point of view, the pair remains in a downtrend and breaks through the support level. We expect the next significant correction at 1.1455 USD for 1 EUR.

Big traders analysis

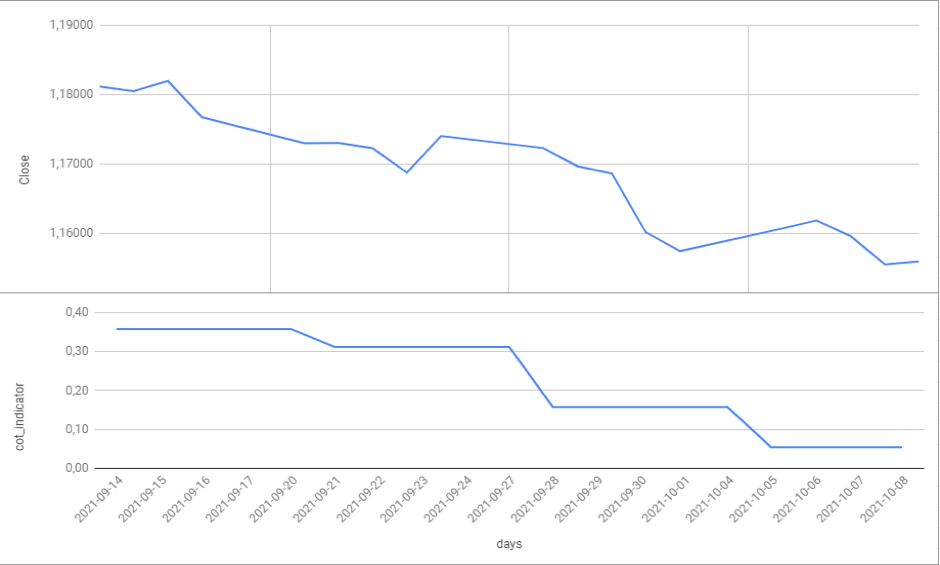

Picture 1. A price chart for the EURUSD and the indicator of big traders for the period from 14.09.2021 to 08.10.2021.

As we can see in picture 1, a sharp decrease in the Euro caused a sharp decline in price against the USD. Also, the trend is more fundamental than speculative.

Forecast

Given all of the above, the asset is expected to remain in a DOWNTREND. It is indicated by another update of the EUR local demand minimum, a deal to increase the US public debt, and the deepening of both currencies into the abyss of the energy crisis.

IronTrade recommends you to use the SMA (25) indicator for better control over your positions.

SMA helps to keep an eye on the trend and ignore minor fluctuations.

IronTrade recommends you to keep on average 2 trades DOWN and 1 trade UP.

Well, why not try a fresh approach on IronTrade? Try it!