New forecasts about the energy crisis are not much about finding efficient solutions but about identifying which raw materials will be in demand next summer. It will affect the Eurozone, which tries to survive on gas shortages, and Tokyo, which expects a rise in oil price by the next summer. Let’s see the analysis of IronTrade experts about all this.

Fundamental arguments

Both countries remain at the center of the energy crises. The demand continues to rise, and the supply remains the same because the “green” energy is not living up to expectations. The Euro has more advantages in this situation because the oil and gas are delivered to Japan by sea and cost more.

Technical arguments

From a technical point of view, the pair remain sideways, not far from the past highs, fluctuating and waiting for new trend drivers, making it ambiguous.

Analysis of big traders positions

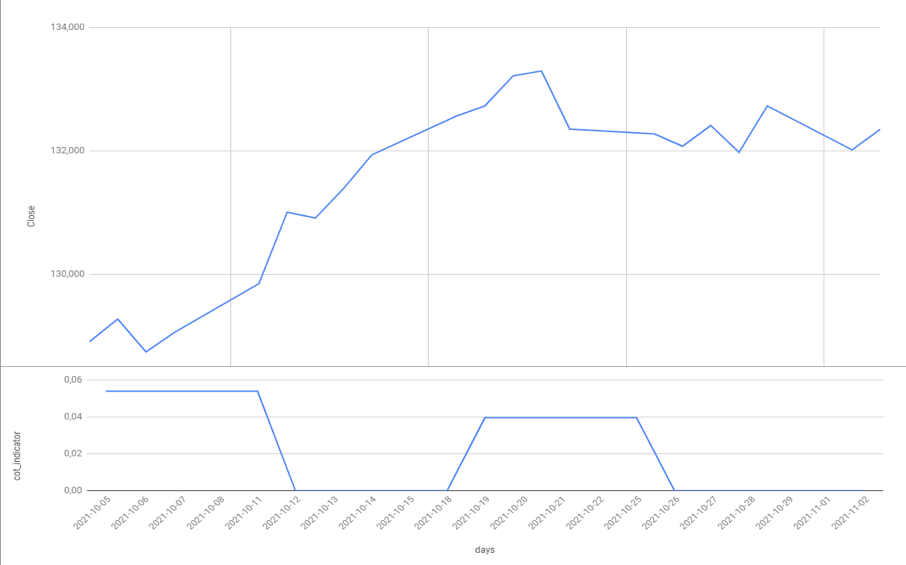

Picture 1. The price chart of the EURJPY and the indicator of big traders for 05.10.2021 – 02.11.2021.

As we can see in picture 1, the indicator continues to form new local minimums, which means the price may go UP.

Forecast

Given all the above, we can conclude that the asset will move UP. It is indicated by another refresh of the local minimum of the big traders’ indicator. Fundamentally the EUR continues to be stronger than the JPY, including the situation with the energy crisis.

We recommend you use the SMA (25) indicator for better control over your positions.

SMA helps to track the trend and do not get distracted by minor fluctuations.

We recommend you to keep at the same time ~ 4 trades up and 3 trades down to keep the level of risk moderate.

Try to take advantage of this strategy on Irontrade.com. It is elementary to use it there and limit your risks by keeping the income high.