Against the background of the withdrawal of troops from Afghanistan and uncertainty of the easing policy, the US Dollar prospects seem very vague. On the other side, refugees and the continuation of the pandemic do not add to the optimism of the Euro.

Fundamental arguments:

As for the USD, it has an ace up its sleeve to reduce any negative. The reduction of the quantitative easing program will stabilize inflation expectations and shape the demand for the USD.

Technical arguments:

From the technical point of view, the currency pair trends downwards, being in the sidewall near the resistance line. Also, the present growth of the EURUSD against the surge failed to cross the resistance line and is the same as the previous surge.

Analysis of big traders positions at IronTrade:

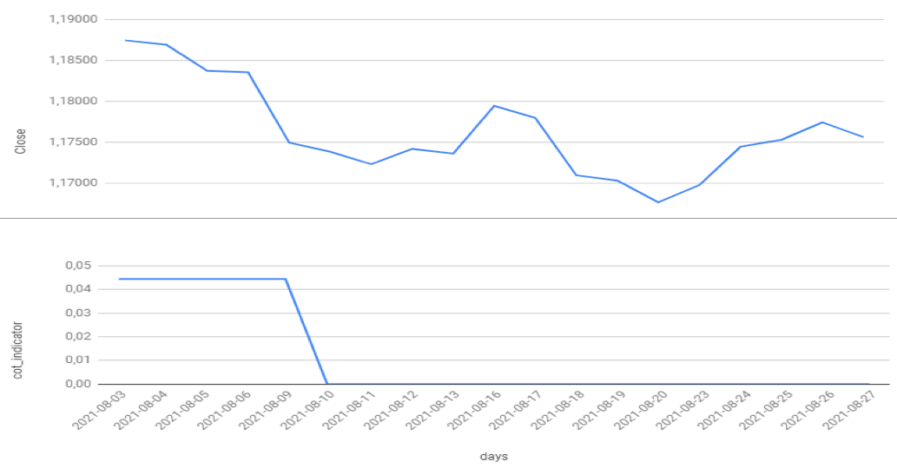

Picture 1. A price chart for the EURUSD and a chart with the indicator of big traders for the period of 03.08.2021 – 27.08.2021 from IronTrade.

As we can see in picture 1, the demand for the Euro continues to refresh the minimums even without local surges. It explains the correction as a temporary and speculative structure on the price chart.

Forecast

To underline everything above, IronTrade experts expect a DOWNWARD movement for the EURUSD. It is indicated by the recent update of the demand figures for the Euro, the strengthening of the USD, and the local cyclical structure of the EURUSD price.

IronTrade recommends using the Stochastic (14, 1, 3) indicator for better control over positions.

Stochastic will help you to recognize market cycle changes in side oscillations.

To keep your level of risk moderate, IronTrade recommends keeping the following ratio of your opened positions:

2 trades DOWN

1 trade UP