Here at IronTrade, we noticed that the Yen remains under pressure, and the US Dollar continues to follow a long-term uptrend after a small rollback. Let’s take a look at a price chart for the last week below and see how the Japanese monetary policy protects domestic industries.

Fundamental arguments

From the fundamental point of view, the domestic market in Japan has faced some challenges. The main issue is that the price of large manufacturers dropped on the background of strengthening the Yen because it reduces their export profits after the conversion to the national currency. Theoretically, the Bank of Japan can stimulate the rollback after intense strengthening, but it will require extra time.

Technical arguments

Technically, the USDJPY currency pair remains in a downtrend. However, the trend is not strong and only accumulating strength these days. There is still a chance for the reversal because of the ambiguous recent peak. Anyway, the dynamics for the USDJPY market demonstrate a downward trend. The only question here – how strong the USD is now?

Big traders position analysis

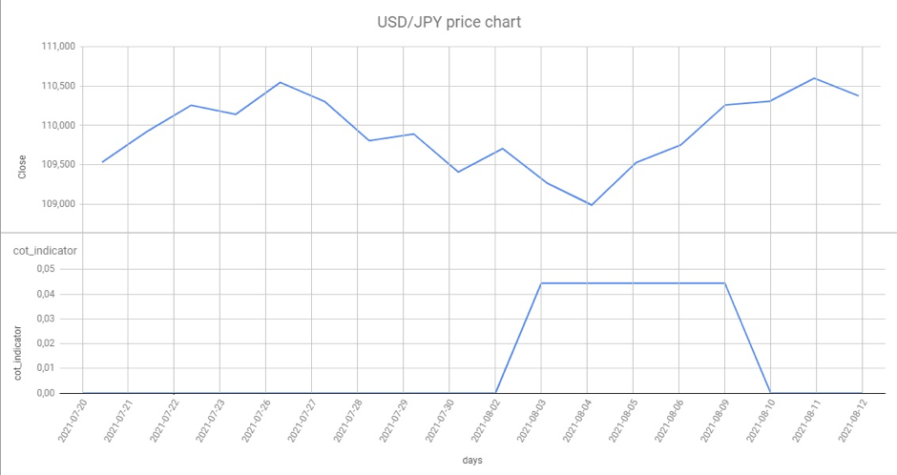

Picture 1. A price chart of USDJPY and an indicator of big traders for the period of 20.07.2021 – 16.08.2021.

As we can see in picture 1, the growing demand for the JPY has caused a USDJPY backlash. At the same time, the trend failed, and demand for the JPY continues to decline rapidly, updating weekly minimums.

Forecast

Taking into consideration all mentioned above, we expect a DOWNWARD movement these days. It is indicated by the lack of demand for the JPY, strengthening the USD and local overbought state of the market.

We recommend using the SMA indicator with a period of 25 days for better control over your positions. SMA will help you to recognize super clear market trends. You can enable this indicator in the Settings at your IronTrade trading room.

Also, we recommend keeping the following ratio of opened trades to keep your win/lose risks moderate: 3 trades DOWN, 2 trades UP simultaneously.

Why not go to your IronTrade account and try this right now?