Despite the fact that the CHF gains on the positive news regarding producer price index and overall bullish moods for the CHF, the USD was too strong, and the Swiss Franc positions are overshadowed by the stronger Dollar.

Fundamental analysis

Nothing happened with the Swiss Franc during the last month. Most of the news remained as expectations or formed positive expectations about the CHF. On the other side, the USD continues to shape a trend based on the expectations of abandoning leniency policies.

Technical analysis

From the technical point of view, the pair aims lower even though the trend is still at an early stage.

Big traders analysis

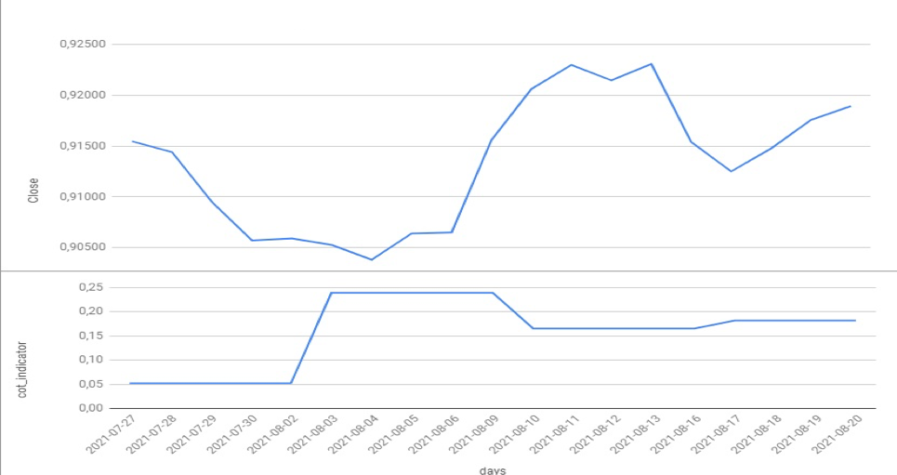

Picture 1. The price chart of the USDCHF and the indicator of Big traders for the period of 27.07.2021 – 20.08.2021

As we can see in picture 1, the higher demand for the CHF caused the rollback in the price of the USDCHF pair. At the same time, long-term updates of the CHF minimums have formed a long-term trend. Positive statistics have caused a local backslide, but current growth is in doubt due to expectations of a new round of US Fed statements and unemployment statistics.

FORECAST

Given all of the above, IronTrade expects the DOWNWARD movement shortly. The leading indicators for this are lack of demand for the CHF, strengthening of the USD, and local overbought state of the market.

IronTrade recommends using the RSI indicator for better control over your positions now. You can enable RSI in the Settings in your IronTrade account.

RSI helps to identify when the markets are overheated. For example, now, the daily trend of the RSI indicates a downward rollback.

We recommend keeping the following ratio of open positions to maintain the best risk-reward ratio:

5 trades downwards AND 4 trades upwards