As we can see from the USD/JPY charts on Irontrade, USD strengthens by supplying liquefied natural gas to the Asian markets. Japan opens its pockets to buy LNG and even competes with China for this opportunity. It indicates that there will be no growth of the Japanese currency at the end of this year.

Fundamental arguments

In winter, is needed more energy than in summer, and Japan has a rich and voracious neighbor (China) ready to hijack any supply in its favor. The USA is just doing business by stimulating demand for USD.

Technical arguments

From the technical point of view, the pair remains in a bull trend. However, if we look locally, there is a minor correction in the market.

Big traders analysis

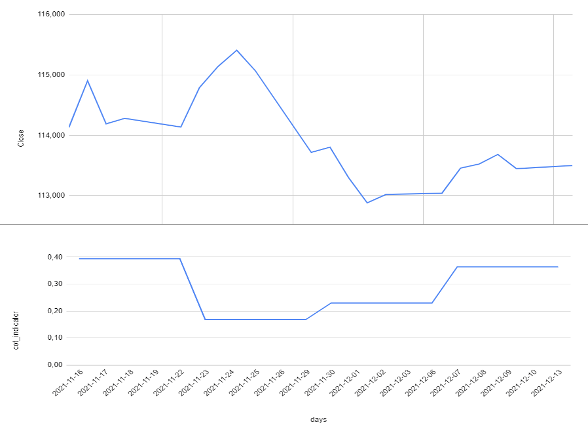

Picture 1. A price chart for the USD/JPY and the indicator of big traders for the period of 16.11.2021 – 13.12.2021 (provided by irontrade.com).

As shown in picture 1, the indicator exhibits possible growth by pointing out a small raise. However, this raise is below the maximum. I.e., with an UPWARD trend and moderate volatility.

Forecast

Given all the above, it should be noted that the asset is expected to move UP. This is indicated by fundamental and technical arguments and by the major traders. Fundamentally, USD is more potent than JPY, even in the energy crisis position.

We advise you to use the Stochastic (14, 3, 1) indicator (applicable to Irontrade).

To keep the level of risk moderate, we recommend keeping on average 4 trades UP and 2 trades DOWN.

Try to implement this trading strategy on Irontrade! It is pretty simple there and very convenient. You can limit your risks by keeping high incomes. Good luck!