According to IronTrade experts, the US Dollar looked better than expected recently, even despite the inflation. However, the overall sentiment for both GBP and USD is not great. Easing measures will be hard to undo amid instability and crisis.

Fundamental arguments

For both currencies, the high energy costs are not good. Still, while the US economy is making super-profits, the Foggy Albion counts every penny and idles strategically essential industries. So, that’s why the USD looks stronger.

Technical arguments

From the technical point of view, the GBP/USD pair remains in a long-term downward trend with temporary corrections. For example, there is such a correction period now. We can already consider that the local minimum has been reached, and the IronTrade experts expect a further upward correction.

Big traders analysis

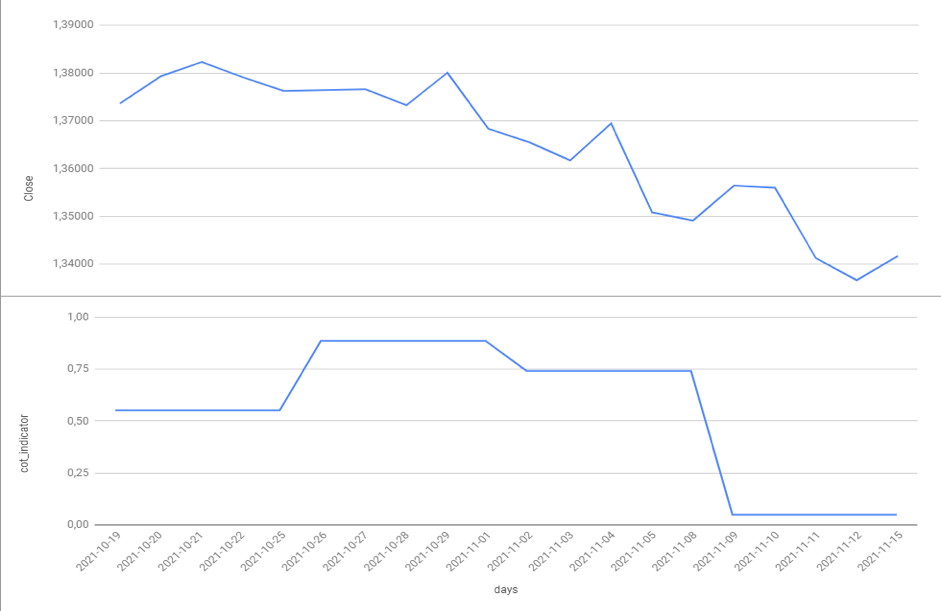

Picture 1. The price chart of GBPUSD and the indicator of big traders for the period 19.10.2021 – 16.11.2021.

As we can see in picture 1, the demand for the GBP has significantly decreased, and the trend remains positive in favor of the USD. Also, the consolidation of demand at low levels is not good for the GBP.

Forecast

Considering all stated above, we expect a slight correction upwards and continuation of the “DOWN” trend for this asset. This is confirmed by the level of demand among big traders, as well as weaker economic prospects.

So, the overall forecast for GBPUSD – DOWNWARDS.

We recommend you use SMA (25) for better control over your positions.

The SMA indicator helps to identify a trend and trade in accordance with its direction.

We recommend keeping 2 trades DOWN, and 1 trade UP to maintain the level of risk moderate.

Try this trading idea on irontrade.com to increase your income and gain maximum from the described scenario.