The current market situation creates clear trends for the USD, which is reflected in the intercontinental pair of the EURUSD. The main reason for uncertainty lies in the fact of how the market estimates all the imperfections of US monetary policy on one side and the possibility of new lockdowns because of a new covid delta strain on another one.

Fundamental arguments

Basically, we will inevitably encounter the revaluation of the EURUSD as the attitude to the USD has changed due to the COVID19 easing policies. Most investors at IronTrade do not consider the current price as fair, nor are they optimistic about inflation expectations. On the other hand, the volatility decreases because of a reduction in the number of hedging trades.

Technical arguments

From a technical point of view, the situation looks like a horizontal channel. On July 29, we noticed a breach of the channel level. However, the EUR dynamics remain in an uptrend. The question is only about the USD.

Analysis of big traders positions

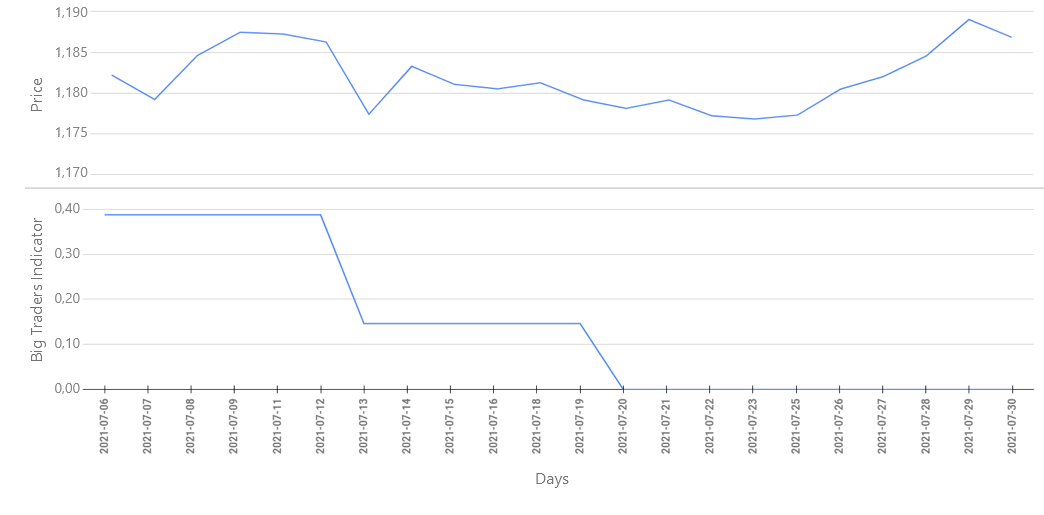

Picture 1. A price chart of the EURUSD and a chart of the indicator of big traders for the period 06.07.2021 – 30.07.2021

As we can see in the chart, the expectations of traders update the minimums that lead the USD to a fall against the EUR. A sharp decrease makes the EUR stronger. However, there is also a significant probability of a correction.

Forecast

So with everything we’ve got going on right now, we assume that the EURUSD will remain in an uptrend, as indicated by the break-up of the channel maximum. Also, there is a trend to reduce the number of opened positions and the uncertainty of the fundamental attractiveness of the USD.

IronTrade recommends using the following indicator for better control over trades: RSI with a period of 14 days.

RSI helps to identify the periods when the market has enough strength to move in a particular direction. You can enable this indicator in the Settings in your IronTrade trading room.

We advise you to keep the following ratio on this week: 4 trades UPWARDS and 3 trades DOWNWARDS.