Every trader, who has ever tried to learn about indicators, knows about Moving Average. Here at IronTrade, we have already made a lot of articles about it. It is the most simple and straightforward tool, which is compatible with almost all other indicators. There are lots of strategies that include it. Usually, traders often use the Moving Average as support for oscillators. It is helpful in both long and short periods.

The new thing here is that you can use several Moving Averages at IronTrade together! As we know, this indicator is based on a calculation of the average price. Turn on several of these indicators and set different time periods, and you will get a better understanding of the prevailing trend.

Though there are many ways of combining Moving Averages, we will explain one of them. It is elementary and available even for very beginners.

Two Moving Averages Together

So, we need two Exponential Moving Averages (EMAs) with two different periods: 14 and 100. It will show you a soft 100-period, which indicates market fluctuations on a bigger scale, and a quick 14-period, which indicates short-term fluctuations.

Remember that no indicators can give you a 100% guarantee of success because the market is a very unpredictable substance. Nevertheless, this approach enhances a standard Moving Average flow and allows traders to open trades with better price conditions.

Setting Up

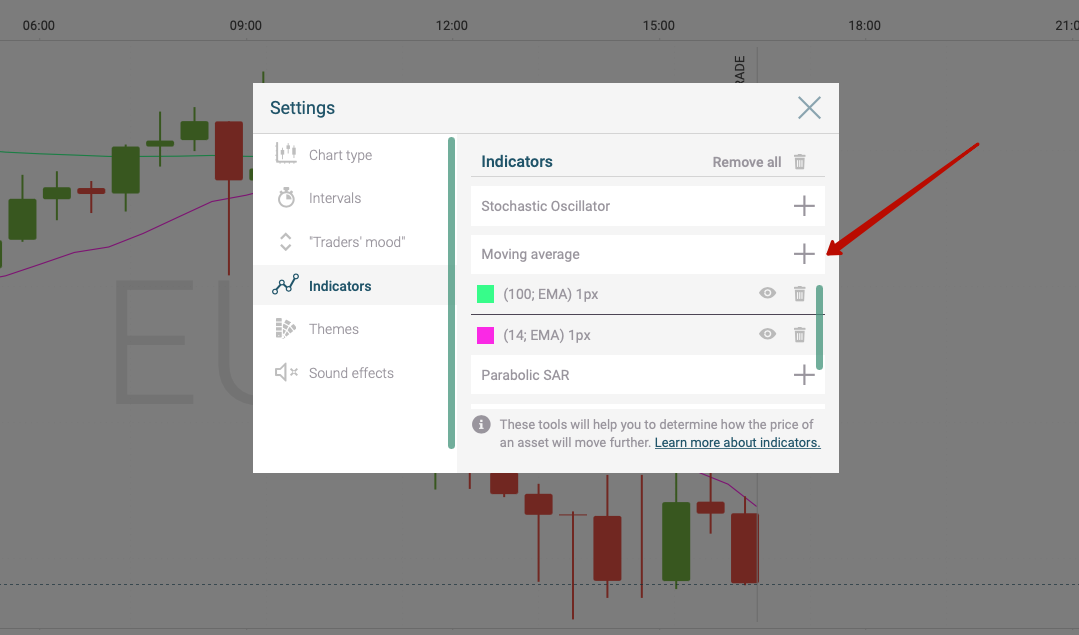

Finally, here is your chance to stop being afraid of using custom settings for indicators. Now we will need to set them up in accordance with our needs. So, first, you need to open the IronTrade trading platform and find the indicator’s settings in the top left corner.

When you enable your Moving Averages, make sure you’ve changed it to EMA. You will need to enable two EMAs. One with a 14 period and another one with a 100 period. Change their colors as well because it will help you to differentiate them.

Picture 1. Enabling 2 Moving Averages on IronTrade.

How To Use Them?

Example 1:

First, wait until the asset price cross and stay above the 100-period EMA. Our example below shows that the asset price bounced back and touched below a 14-period EMA. It is the time when you can open a trade at a lower price. The first green candlestick after this touch should close slightly below or above the 14-period EMA. When the candle closes, it is time to open a trade:

Picture 2. An example of a buying trade using the help of 2 Moving Averages.

Example 2:

Another way is to play downwards. Here is what you need to see: the 14-period EMA and the price chart cross and stay below the 100-period EMA.

When the price bounces upwards, testing the 14-period EMA, it is time to open a downwards trade at a higher price.

You can open a trade once the first red candlestick after the bounce closes.

Picture 3. An example of downwards trade using 2 Moving Averages.

To sum it up, we can say that 2 Moving Averages require minimal knowledge and settings. With all this simplicity, it gives a trader a lot of information regarding the direction of a price. Don’t forget to stay attentive when trading with any trading strategy, and good luck! Try this strategy on IronTrade right now!