According to the EUR/USD price trend on IronTrade.com, the USD is getting stronger. The Dollar started to strengthen at the first expectations of the cancellation of quantitative easing. It continues its strengthening trend by exporting inflation to the Eurozone, making the EUR position even weaker.

Fundamental arguments

From a fundamental point of view, inflation negatively affects the economy of the Eurozone. At the same time, the USA continues to make money from liquefied natural gas. Also, they drop prices for energy resources from time to time by making news blasts ensuring their own energy goals and currency appreciation.

Technical arguments

The DOWNWARD trend is bright and clear.

Big traders analysis

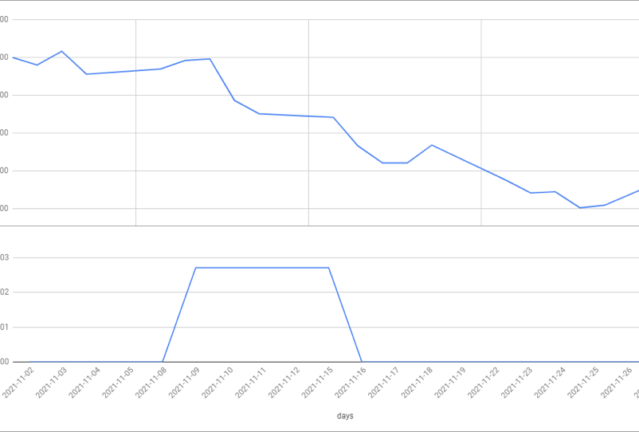

Picture 1. The EUR/USD price chart and the indicator of big traders for the period of 02.11.2021 – 29.11.2021 (all the data is provided by IronTrade).

As we can see in picture 1, the continuing decline in demand for the EUR puts pressure on the asset. We can also see that the trend is unambiguously confirmed both technically and fundamentally and is supported by the demand for the currency.

Forecast

Given all the above, the asset is expected to move “DOWN”. This is indicated by another update of the local demand minimum for the EUR. Due to fundamental and technical reasons, we can see a new minimum as early as this week.

We recommend using SMA (25) for better control over your positions. SMA helps to identify a current price trend and open trades in accordance with the trend direction.

We recommend keeping on average 4 trades DOWN and 1 trade UP at the same time.

Try to implement this strategy on Irontrade! With IronTrade, you can effectively limit risks and get higher income from each trade!