While the Australian economy suffers an extended lockdown and Europe has failed to find a solution for current problems, the ongoing global crisis continues to eat major economies. An essential link in the future course is the outlook for global inflation and how cold the current winter will prove to be. Let’s see the IronTrade analysis of the current situation.

Fundamental arguments

From the fundamental point of view, the European economy looks more robust than the Australian. It happened even despite the fact that the energy crisis has raised the cost of some energy resources. While Europe has to pay for them, Australia remains a coal exporter and gets paid. The thaw in the Chinese direction is also welcomed by the market.

Technical arguments

From the technical point of view, the AUD is getting stronger, and it seems like the asset will remain in a strong DOWNWARDS trend after a short correction.

Big traders analysis

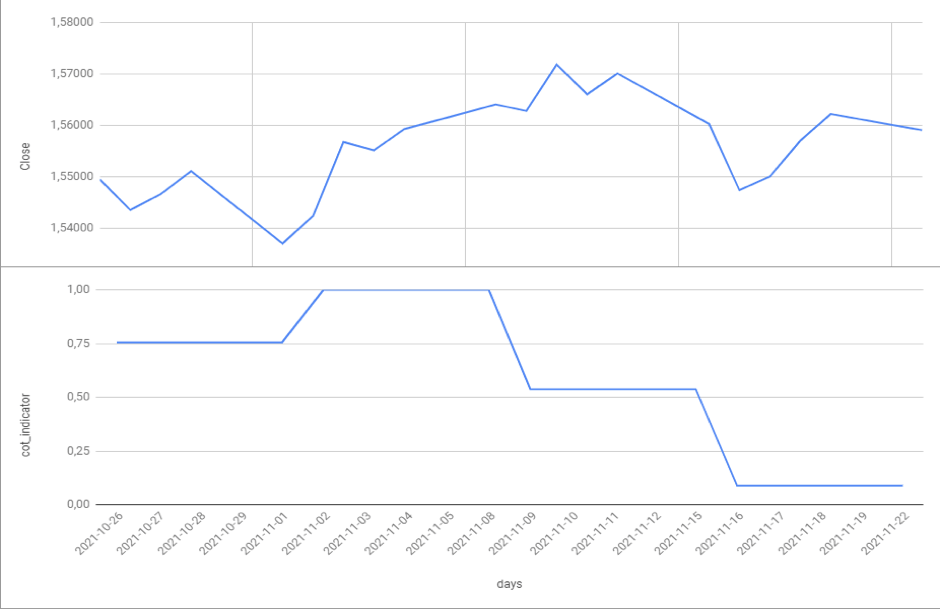

Picture 1. A price chart of the EUR/AUD and the indicator of big traders for the period 26.10.2021 – 22.11.2021.

As we can see in picture 1, the sharp decline in demand is accompanied by a smooth fall in price. Such a situation strengthens the AUD by supporting demand at the expense of a slightly higher interest rate.

Forecast

Given all the above, the asset is expected to move DOWN. This is indicated by a favorable situation in the energy market (for Australia). The trades of the prominent traders are also pushing the AUD up.

We recommend using SMA (10) for better control over your positions.

SMA helps to move along the trend and ignore minor fluctuations.

We suggest keeping an average ratio of 3 trades down, 1 trade up simultaneously to keep the level of risk moderate.

You can try to implement this strategy successfully on IronTrade.com. Here you can effectively limit the risks and get a high yield from each trade! Good luck!