The results of the quantitative easing are now playing against both the USD and the EUR. However, the EUR remains in trouble at that moment because inflation keeps rising, and a rate hike would hit the real economy very hard. On the other hand, the Dollar looks confident at the moment.

Fundamental arguments

From a fundamental point of view, rising inflation hurts the economic condition of the Eurozone. However, raising the rate will significantly hit the producers, who are already looking for ways to survive in the current difficult situation.

Technical arguments

From the technical point of view, the price remains at the support level, constantly trying to break the level down.

Big traders analysis

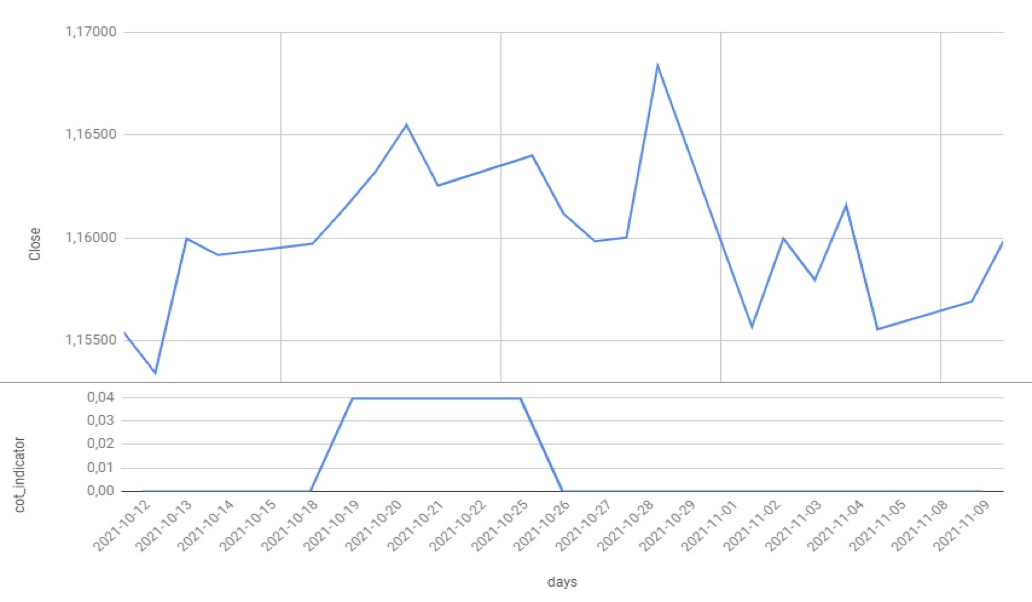

Picture 1. A price chart of the EUR/USD and the indicator of big traders for the period 12.10.2021 – 09.11.2021.

As we can see in picture 1, the continuing decline in demand for the EUR puts pressure on the asset price. We can also see that the trend is more fundamental than speculative in nature.

Forecast

Given all the above, IronTrade experts assume that the asset may remain in a downward trend, which is indicated by another update of the local demand minimum for the EUR. It happens in the background of uncertainty and difficult rate choice, without a possible gain from it.

We recommend you to use the RSI (14) indicator for better control over your positions.

RSI helps determine the “overbought” and “oversold” levels of the asset and indicates the overall market mood.

We recommend you to keep on average 2 trades DOWN and 1 trade UP simultaneously to keep the level of risk moderate while trading on Irontrade.

To get the most from this strategy, try implementing it on Irontrade.com. Here you can effectively limit the risks and get a higher yield from every trade.