While there are hundreds of different trading strategies and methods out there, finding the one that works for you is a challenge.

Some strategies are not suitable for you, and some do not seem trustworthy. The truth is that there is no such thing as the best strategy.

… but everyone can create their own strategy. You can find the system that works most beneficial for you.

1. Short timeframes for your trades

With short timeframes you may focus on technical analysis.

Though there are no methods or analytical instruments that could guarantee utter success, using indicators may help. Check how the asset behaves on a shorter timeframe and make faster and more well-read decisions.

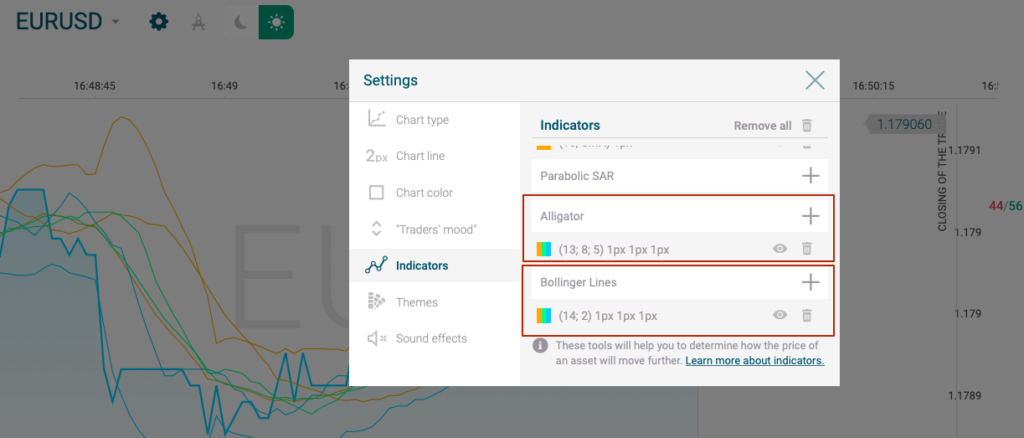

Some indicators can be tailored for short-term trading. For example, The Alligator, Bollinger Lines, or Moving Average.

Scalping or Breakout area couple of intraday trading strategies that short-term traders may use to take advantage of small changes in the asset price.

You can find all the assets and indicators easily accessible on your IronTrade dashboard, just sign in to choose your currency pairs and start trading.

Usually, the traders who prefer short timeframes use trading sequences. It’s important to consider the risks involved with this approach – don’t rush into it.

2. Swing Trading

In swing trading, a trader usually uses technical analysis to look for certain patterns (upward or downward trends in the market). Technical analysis involves using indicators, such as chart tools, to analyse past performance. Then you can determine the direction of price movements.

The main idea of swing trading is to recognize a market trend and try to time the entry into a position to catch (and ride) the wave before it breaks. A rising wave can be seen as an upward swing and likewise, a falling wave is a downward swing.

For this strategy, you can make use of the trading indicators we provide, such as moving averages and Bollinger Bands, which are offered free of charge to all traders.

The Key Characteristic: A single trade aimed at catching a trend and which is held for a longer time frame.

3. Position Trading

Position trading is a medium-term holding strategy where traders keep positions open for more extended periods such as days or weeks.

A position trader may wait until a currency pair, such as EURUSD, reaches a specific support level before taking a long position or a particular resistance level before taking a short position – and holding it for a few weeks.

This includes: gross domestic product, supply-to-demand ratio, rate of employment, rate of inflation, ease of doing business, and so on.

To see when major economic events take place, you can check the Analytics page on IronTrade’s website.

A position trader may wait until a currency pair, such as USDJPY, reaches a specific support level before taking a long position, or a specific resistance level before taking a short position – and holding it for a few weeks.

There is less immediacy with this type of trading, as traders are not really concerned with intraday prices and generally open a small number of positions. However, you need to have a good grasp of market fundamentals if you need to rely on fundamental analysis.

The Key Characteristic: A single or few large-size trades held for a relatively long time frame.

4. The Forex Bank Trading Strategy

Unlike you and I, because of the huge volume they control, banks must enter positions over time that often show visibly as range-bound or sideways price action.

We call this accumulation as they are areas where smart money frequently enters or ‘accumulates’ their desired position over multiple hours or longer.

As their principal role is making the market, they make money by accumulating a long position that is later sold off at a higher price or accumulating a short position they will later cover or buy back at a lower price.

Over the last years of educating traders, I’ve listened many forex traders say that it feels as if they are entering the market at precisely the wrong time.

A lot of traders think that the market is just waiting for them to enter before it immediately turns in the opposite direction. Not only is that true, but the step called ‘market manipulation’ is critical to tracking banking activity in the forex market.

The first point I want to mention is that we use the term ‘market manipulation’ but you could just as accurately describe it as a search for liquidity, a trapping move, stop hunt, and so on.

Regardless of the reason, the manipulation or ‘false push’ that comes at the end of the accumulation phase, is the most critical factor in tracking smart money.

The final step after the manipulation is where the money is made: the market begins to trend. The goal is to not only avoid the trap of chasing the false break (as most retail traders do) but also profit from it.

You can do this by ONLY trading AFTER a manipulation move, or false push is clearly visible, and you have a valid stop run and confirmation to ensure the trade entry.

By correctly identifying which direction they have manipulated the market, we can then recognize which direction they intend to push the price, giving us a massive advantage.

This is the most accessible area for us to profit from, but only if we can correctly identify the first two steps in the process.

5. The trend is your friend

“The market being in a trend is the main thing that eventually gets us in a trade,” Legend Richard Dennis says.

Dennis would say he is self-taught. “I had very pale ideas, rules, and attitudes about the market then. But a few that I learned were right, like go with the trend.”

Seems like he underestimated the importance of his relation toward trend following — a market approach that leverages momentum and moving averages to define sell and buy points.

Eventually, this strategy would serve as the basis of Dennis’ whole trading methodology.

Once Dennis found his niche, the floodgates opened.

6. Find comfort in the uncertainty

When thinking about crypto, for example, we know less than something like tech stocks.

But just to clarify, we also know less regarding IT stocks than we think we do.

… That’s the first thing you need to understand.

The second thing you need to realize is that the higher degree of uncertainty, the less likely it is that your model is going to be perfectly accurate.

Under those conditions, you need to consider mitigating downside outcomes. This is critical because when you have less accuracy in your prediction models, there is a bigger chance of getting an unfavorable result.

This first step is to make sure you have a perfect quitting strategy. So what do I mean by that? The higher the risk, the more you should value liquidity.

On the other hand, you might want to change your mind in both directions, meaning you could wish to press your position under different circumstances.

Another helpful strategy is spreading your investments to mitigate the chance that you are wrong about any single trade. Always prepare for uncertainty, and lean into it. That’s part of the territory!

7. Betting against hysteria can pay off

Jim Rogers is another legendary trader, worth over $300 million – and his strategy got him there. His philosophy is opposite to our man Dennis, you could say.

“When I see madness, I usually like to take a look to see if I shouldn’t be going the other way,” he said.

In the late ’70s, Rogers decided to short gold after a greedy move to the upside.

Rogers said he formed this view after listening to Federal Reserve Chair Paul Volcker, who vehemently spoke about suppressing inflation. That catalyzed Roger’s conviction.

“Never, ever, follow traditional wisdom in the market,” he said. “You have to learn to go counter to the markets. You have to learn how to think for yourself, to be able to see that the emperor has no garments.”

Rogers still practices what he preaches. While many have heralded Federal Reserve policy and government stimulus as positives for markets, Rogers says he believes the results from these actions will “be terrible.”

Follow our news and updates at IronTrade to keep your eye on up and coming trends, tendencies, and bouts of hysteria. Now you’ll know exactly what to do.