According to data provided by Irontrade.com, the situation between AUD and USD remains relatively calm. The Australian Dollar looks good on the background of renewed coal shipments to China. The virus situation is getting better, and it fades into the background in many countries.

Fundamental arguments

Stable production of resources(including different energy types) helps maintain the demand for the currency on foreign exchange markets.

Technical arguments

Technically, AUD is near the support line. It means that the asset is likely to move up.

Analysis of big traders

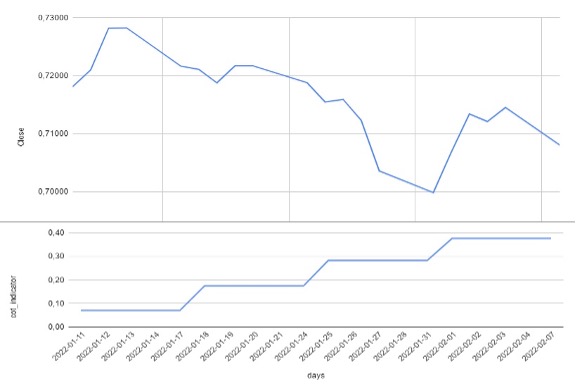

Picture 1. The price chart of AUD/USD and the indicator of big traders for the period of 11.01.2021 – 07.01.2022. The data is presented by Irontrade.com.

As we can see in picture 1, despite the increase in demand for AUD, the currency fluctuations are accompanied by corrections, testing the established support line.

Forecast

The asset is expected to move UP. It is indicated by three factors: decreasing the COVID tensions, the proximity of a support level, and smooth but steady growth in demand for AUD.

We recommend using the RSI(14) indicator to better control your positions. RSI helps determine the “overbought” and “oversold” levels of the asset and indicates market sentiment.

We recommend keeping 3 trades UP and 1 trade DOWN to keep the level of risk moderate.

Try to implement this strategy on Irontrade. It has a simple and straightforward interface with the option to limit risks while keeping high profits. Good luck!