According to the charts from Irontrade.com, the most significant part of traders is already gone for holidays. The liquidity and volatility are pretty low now. However, let’s check if there is still any room for positivity at the beginning of the next year for EUR and USD? At the moment, it seems that the crisis has passed its peak, but forecasters are predicting the repetition of waves of frosts and thaws.

Fundamental arguments

From the fundamental point of view, the dependence of EUR on natural gas is only growing, and the temporary respite on Asian markets is about to end. The cost of energy will reach new highs soon.

Technical arguments

Technically, the price is locked in and requires a correction. It will happen after a sharp drop.

Big traders positions

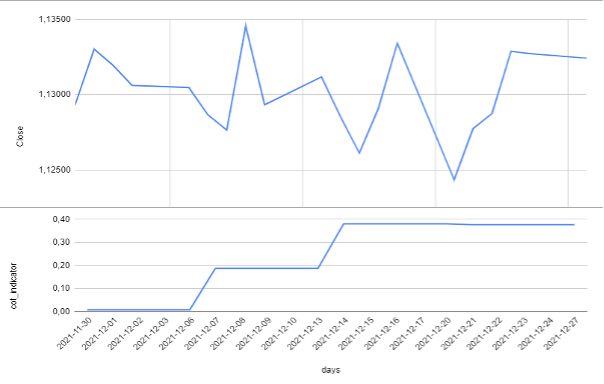

Picture 1. The price chart of EUR/USD and the indicator of big traders for 12.10.2021 – 09.11.2021 (presented by Irontrade).

As we can see in picture 1, the demand for EUR is corrected and caused a stabilization. Further strengthening is only possible in the short term.

Forecast

It seems like the asset is expected to move UP, as indicated by the EUR demand correction amid falling gas prices (yoohoo, the green energy is getting back (sarcasm)). Also, a small energy sufficiency cycle in Asia helps here. However, it looks like we could see USD at the EUR price this year.

We recommend using RSI (14) for better control over your positions.

RSI helps determine the “overbought” and “oversold” levels of the asset and indicates the market mood.

We suggest keeping an average ratio of 2 trades UP, 1 trade DOWN to keep the level of risk moderate.

Try to implement this strategy on IronTrade.com. On IronTrade, you can effectively limit the risks and get a high income per trade! Good luck!