One of the main things that beginner traders at IronTrade should learn is how to spot candlestick patterns. In other words, how to recognize patterns on a chart and make investments according to their state. It is much easier than using technical indicators. Some patterns succeed better than others, but remember that there is no 100% guarantee. By learning how to find patterns, you will be able to recognize them faster and increase your chances for a correct forecast by using multiple patterns at once.

Today let’s start with one of the most popular patterns named the Flag. Its name derives from the shape it forms on a chart. The Flag is formed with support and resistance lines and indicates a heavy trending movement with minor pullbacks. Now we will show you what it looks like.

How can I spot the Flag pattern?

Generally, the Flag pattern emerges after a robust trending movement. The Flag here is represented by a minor short-term pullback. The flag pole is a long trending line.

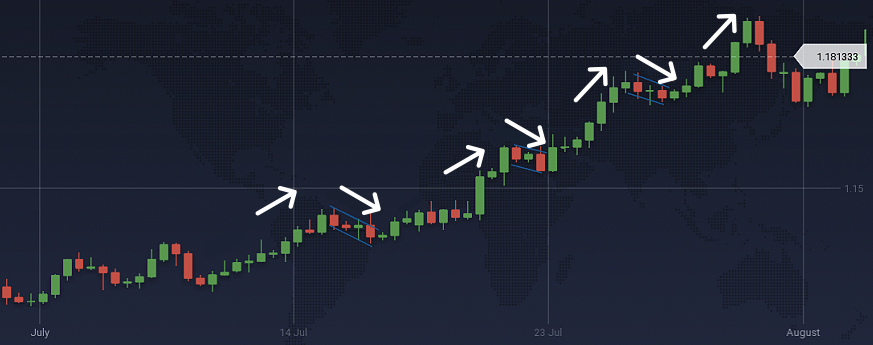

This is how upward poles of the Flag pattern look like

In this example, we have the EURUSD pair trending up. We can see how several flags appear during a robust upward movement. From time to time, the price movement pauses at the flag and rises with a new flag pole. The proof of the pattern is received when the price breaks through the previous high. The best time to open position here is at the first flag formation.

The same can happen with a downward trend when the flag pole is downward, after which the price has a minor pullback upward.

This is how downward poles of the Flag pattern look like

From our experience, the longer the flag, the better its performance. However, if a flag is too long, it may continue with the price moving in the same direction instead of a price reversal. You should be careful and double-check if the price is going to break through the flag in the path it was following before the flag formation.

When can I trade with the flag pattern?

You can start spotting the flag pattern after a breakout of the price. For example, the first flag (minor pullback) is formed when the price breaks through the support or resistance lines. Also, you can recognize the Flag pattern during solid trends on the market.

Finally, we can conclude that the flag pattern may be good for newbie traders because it is relatively simple to recognize. For better understanding, we recommend trying to find the Flag pattern on different currency pair charts at your IronTrade account.