According to the data provided by Irontrade, the situation about CAD and USD remains relatively stable. The CAD shows an average dynamic against the USD with decreased volatility, making the situation predictable.

Fundamental arguments

Fundamentally, it is impossible for the situation with the CAD now to decrease in value. In fact, it is quite the opposite – the stable production of resources, including energy resources, allows them to do this calmly.

Technical arguments

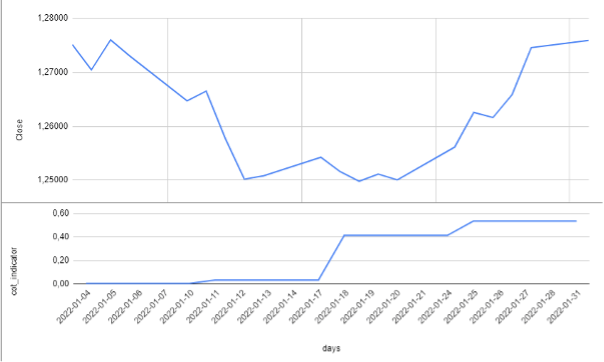

Technically, the CAD looks slightly cheaper and continues to maintain its falling medium-term trend with possible correction near the resistance line at the 1.28 USDCAD level.

Big traders analysis

Picture 1. The USDCAD price chart and the indicator of big traders for the period 04.01.2021 – 31.01.2022. Presented by Irontrade.com.

In Picture 1, we can see that despite the increase in demand for the CAD, the currency fluctuations are accompanied by enormous hedges, which leads to both effects. Which, in this case, is a rather unique situation.

Forecast

We expect the asset to move DOWN. It is indicated by several factors. The stability and sustainability of development in Canada are not in doubt. Technically and positively, it is clear that large hedges are already far in the money and soon need to take profits to maintain margin, which will affect the growth of the CAD.

We advise using the RSI (7) to control your positions more conveniently. RSI helps to define “overbought” and “oversold” levels for the asset and indicates the market sentiment.

We suggest keeping an average ratio of 3 trades DOWN 1 trade UP to keep the level of risk moderate. Try this strategy at IronTrade.com! It’s quite easy and convenient to limit the risks while getting high returns. Good luck!