According to the charts provided by IronTrade, the start of the year seems to be hotter than the energy resources. The fight for them is still in place. However, it is still unclear if there is a period of peace after the energy war and who will be the winner. Not the consumers for sure.

Fundamental arguments

From the fundamental point of view, now is the middle of the heating period for the EURO. Even though the supplies are low, it seems like European countries will survive until the weather gets hotter. The U.S. continues to actively profit from natural gas transactions, actively using it as a lever to pressure anyone who wants to use this gas.

Technical arguments

From the technical point of view, the price is fixed at a certain level and requires a correction after a sharp drop.

Big traders analysis

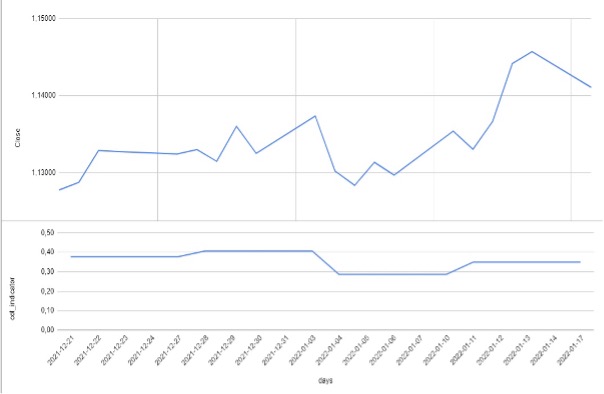

Picture 1. The price chart of EURUSD and the indicator of big traders for 21.12.2021 – 17.01.2022 (provided by IronTrade).

As we can see in picture 1, the demand for the EURO got corrected and stabilized. The strengthening is only possible in a short-term period. The market, in many respects, is ready to correct, which is indicated by the rapid growth of the price. It is indicated by a relatively modest increase in demand, and even the general drawdown does not cause negativity.

Forecast

We expect the asset to move “UP“, which is indicated by a demand correction of the EURO. It happens mainly due to the bullish sentiment in the market and the approach of a warm season.

We recommend using the RSI (14) indicator for better control over your positions. RSI helps determine the “overbought” and “oversold” levels of the asset and indicates the market mood.

We recommend you to keep on average 3 trades UP and 1 trade DOWN at the same time.

Try implementing this strategy on IronTrade.com. There you can effectively limit the risks and get a high yield per transaction. Good luck!